After somewhat unproductive day in Seoul, it was great to get on the airplane. Departure time was 12:30PM, so perfect time for peak performance.

I started off reviewing the budgetary costing and pricing for Project Genie. Mina did a costing on her own and I also had run one through using MS Project. Both came in very, very close to each other, so that means we are not far off the real cost of the project. Goal of Genie is to execute it on cost basis, and take the risk – and make it pay back over long period of time. So, given that this was just a costing exercise, which didn’t require any ‘sales’ spin – it was easy. We actually didn’t account for any of mine and Mina’s time in the project – which alone would double project costs.

Regardless, looking over it – project looks good – we are about 80% in terms of execution.

After the Genie review I jumped into the Shareholder agreement, and using C… tool, I spend 4 or 5 hours looking at valuations and deep diving into NPV, IRR, DCF calculations, etc.

To make this go, I ended up working on a thing I had wanted to do for some time, and that is to estimate the labor costs for fully staffing Team 2 for site deployment – this is to give me capability to do 10 sites a year.

Basically, I need to burn through $400K USD/year in additional staff to be able to launch 10 sites per year, all while having the ability to maintain my life balance. I could probably cut this down to $200K USD/year if I worked my old 100-120h/week schedule – BUT – those days are over. This gives me launch capabilities. I wanted to get a 3 year runway, so that I could become strategic instead of tactical – so basically need about $1MM USD to move this forward.

Deep diving into numbers identified a few interesting things.

First, I realized that my goal of $125MM is not well defined? Does $125MM mean:

- I own $125MM

- Business is worth $125MM

- Sales are $125MM

So, this thought process, led me to the shares to issue and value of shares (and I will have to redefine what I mean by $125MM soon)

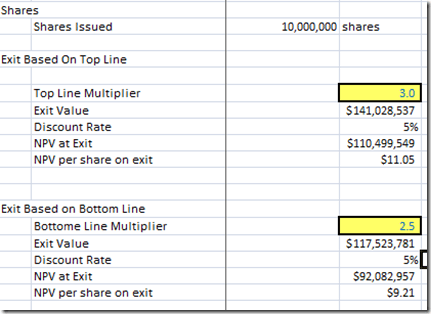

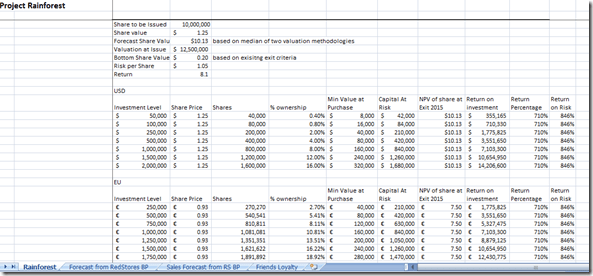

Basically, I decided to issue 10,000,000 at $1.25/share. Using two exit methodologies – Top Line and Bottom Line (DCFed to NPV), the forecast at 5 years is value around $110MM or $120MM.

The exit point should yield around $10-$11/share – or approx. 800% return. The nice thing is that since RedStores is already up and yielding, even at initial entry the shareholders have an initial valuation of each share. For example, value of each share now is $0.20. The purchase price is $1.25.

The exit point should yield around $10-$11/share – or approx. 800% return. The nice thing is that since RedStores is already up and yielding, even at initial entry the shareholders have an initial valuation of each share. For example, value of each share now is $0.20. The purchase price is $1.25.

So, right away, the risk on each share is reduced by $0.20 – plus since the business has passed the 5 year critical mark – the risk is further reduced.

This also tells me that in 5 years I will be for sure able to go public as I had wanted and more likely sooner but….

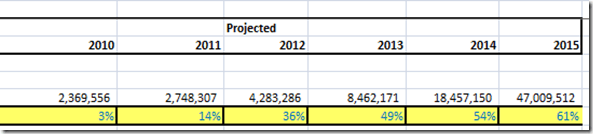

My sales forecast are quite delayed, using my site maturity model. Even despite all the delayed growth, I’m hitting valuation of $125MM in 2015. I’m not including in this forecast Genie which is likely to blow these numbers out of the water – so I’m forecasting using the 2015 number, based on 60 sites, each pulling in revenue of $700K! (Yep, no super star sites, just 60 sites, each doing $50K/month). A super star or two in there, and the averages go through the roof. So, 2015 give me a conservative ‘investor’ valuation – as to make sure that there is no elevated expectations. Meanwhile, I fully expect to beat the 2015 by 2 years and hit my 2013 goal.

In any event, here is the shareholding and offering structure:

Friends Loyalty: Of the things I had wanted to do, is to say thank you to the friends that had supported me through last few years and to people that had worked for me at below market level. C…. had a great idea on how to valuate their support. Basically, you look at how much they have been paid for the funds, and how much they should have been paid. You derive a value based on that, and then can issue shares to them based on the ‘missed’ value they didn’t get through investing but loaning. Its not a huge deal, but important to me, since I think its really important to look after your friends – and perhaps even better, when you don’t want anything in exchange. So, basically, around 100,000 shares will go out, to those that had supported me in the past.

I’m now starting to think of perhaps a more beneficial deal on Genie – with

I’m now starting to think of perhaps a more beneficial deal on Genie – with  the share structure in place, it seems it has unlocked a whole range of possibilities that where not there before.

the share structure in place, it seems it has unlocked a whole range of possibilities that where not there before.

I’m writing this blog as the airplane is over Moscow and I’m having having Korean traditional dinner. I would be lying if I didn’t feel a bit cool at this moment! :) But, jet lag will soon set it, so may as well enjoy the cool feeling while it last.

Below are some photos of me working – I’m listing to 3 Doors and The Killers – and deep diving into financial forecasting! The cabin is empty except for me – so it actually feels like I’m on my own jet. Now, to keep this real – I would NOT pay for first class – so the only reason I can do first class is because of pile of air miles. So, basically, I’m in first for free – and at this level – even if I value my hour at $1K– I could still not justify the $10K for the first seat. So, bless those air miles.

To Do:

- Rethink Genie business terms perhaps in terms of share ownership/project mixture.

- Think of how to get my Vested Contributors into the share structure (very difficult in China – so may have to invent some kind of shadow stock program – otherwise – huge overhead to set this up for Chinese Nationals)

- Review my logic with C… when I’m back or even via Skype tonight when I hit my hotel in Germany.

0 Comments