Had a very nice day today – Alex was over today until 6PM – and her friend Caroline came over. The girls played well together and then they proceeded to gang up on me in a game of Pictureurka. I lost.

But, not all was lost, since afterwards, Mr. K and I met at RedStores office and had a great discussion about:

1. on boarding the A team

2. the German opportunity

3. Funding and IPO play

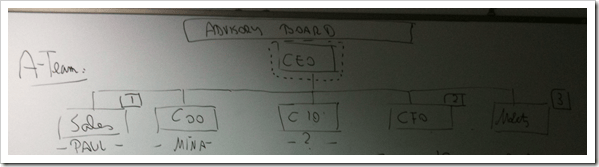

In terms on on boarding the A team, we identified the key positions, notably:

CEO, Sales, COO, CIO, CFO and Marketing.

On top, the plan is to put in an Advisory Board, and likely a Board. We have identified the CFO (Mr. K), and a potentially a high level marketing person. I would likely remain as CEO for next while (at least 3 years) – during the growth period – and when growth is stable (if that makes any sense) – bring in a professional operational CEO.

Lots of discussion around participation of A team – be it salary, ownership, etc. Nothing settled but good framework.

Beyond that we spend a lot of time working out options for the German opportunity and playing out win/win scenarios. Basically, by out estimation, RedStores is able to bring a $1MM value to a customer, nearly risk free, in a few months. That had been my goal originally – to be able to launch a $1MM looking store, in a month, for a small fraction of that price. I think the vision and value proposition is realized – and now we need to go to the market (as we are in Germany) and share with out potential partners the proposition.

We struggled with a few strategic long term, IPO focused issued, such as control of supply chain, the look of the balance sheet, profit/revenue model, etc. We are both of the idea that our discussions in Germany will provide good illumination as to how the strategy looks from the customers side.

Regardless, the German opportunity on its own merit hold value – it may not fit perfectly into the model – since we would likely be going to the German market with a established brand – but again – we will need to explore this with our friends in Germany to find out what is important to them, how they value things and what is important. So, I expect Germany to be a great learning experience – weather a deal is made or not – it will help not only RedStores but also I believe the German partner – so already we are at win/win. From here, we can only make it better.

Next steps for me, is to put together an advisory board – and to really focus on getting the Shareholder agreement in place. The shareholder agreement is needed not so much for investment / cash point of view, but to allow on-boarding of the A team. The idea of funding, as Mr. K pointed out, is best to be delayed till later, as the valuation over next year could be much more significant – basically – it means that today $1MM investment may net someone 20% in the business, but that $1MM 12 months, may cost only 5% – so, basically, we want to defer the funding as late as possible – as it will allow for the business model to show positive impact – reducing risk, increasing balance sheet and providing greater yield for equity shared.

My next week is a VERY busy week – I have a large agenda to prepare for, and I’m still short handed since both Mina and Jessica are out of the office. Nevertheless, things are running well – and my focus for this week needs to be to put together the slideware and discussion points for the upcoming trip.

Once I’m back from Germany, I will be reaching out to my personal board, and working with them to make them a more ‘official’ part of RedStores.com as an advisory board.

Above is the working board (I had blurred it due its confidential nature) – but it was a great way to frame out the issues and the complexities of where things are going.

0 Comments